Video of Car in Chiswick Key Evidence in Murder Inquiry

Family call for end to the silence over the killing of Alexander Kareem

White Range Rover Evoque on Turnham Green Terrace. Picture: Met Police

January 26, 2021

Video footage showing a white Range Rover passing through Chiswick has been released again by police as the family of a murder victim made a heartfelt plea for witnesses to come forward.

Alexander Kareem was fatally shot at 12:40am on Monday, 8 June 2020 as he walked along Askew Road, W12. He had just left a shop and was heading to a friend's house. His death is believed to have been a case of mistaken identity.

Seven months on, detectives are reissuing CCTV of a white Range Rover which was found burned out on Ascott Avenue in Ealing just 25 minutes after the first call to police. The car is pictured driving under the railway bridge at Turnham Green Terrace then later is shown at the junction with Heathfield Terrace on Chiswick High Road. The police have said they believe information about this vehicle could provide the key piece of evidence needed to catch Alexander’s killer.

White Range Rover Evoque on Chiswick High Road. Picture: Met Police

A vast trawl of CCTV has taken place to track its movement across London, but officers still want to hear from anyone who knows anything about its movements on the night of the murder or before. They are also keen to hear from anyone with any other information, no matter how minor, that may help advance their investigation.

In all nine people have been arrested in connection with the inquiry but they have all since been released under investigation.

Alexander’s family are now making a renewed appeal with the approach of what would have been his 21st birthday.

They have released the following statement, “The grief we continue to feel for the loss of our Alexander is immeasurable. Our hearts have been broken. Every day that goes by that we do not know who did this to him is unbearable.

"Alexander was a caring and loving boy who had his life tragically cut short by being in the wrong place, at the wrong time. He was like any other young boy who liked to hang out with his friends, play on his computer and work on his passion which was IT.

"March will mark Alexander's 21st birthday, a day that would have been full of celebration to mark the wonderful, kind and intelligent young man he was.

"We are asking you to come forward with any information you may have, we need answers for us to start to heal. The perpetrators are using the silence of the public as protection against the consequences of their hideous and unspeakable crime.

"Please, protect them no longer. Pick up the phone and do the right thing for Alexander, his friends and for us, his family."

The independent charity Crimestoppers is offering a £10,000 reward for information that leads to the arrest of the person or people responsible for Alexander's murder.

Detective Chief Inspector Wayne Jolley, from the Met's Specialist Crime Command (Homicide), said, "The investigation continues at great pace. We still believe the answers to a lot of the questions are linked to the white Range Rover in the CCTV we're reissuing today.

“We are determined to find those responsible for this terrible crime which resulted in Alexander tragically losing his life. We are working to find the answers for his family who have been left devastated by his loss.

"If you know anything, no matter how small or insignificant you think it is, please come forward. If you do not wish to speak to police, call Crimestoppers which is 100 per cent anonymous.

“We are sure there are people out there who know what happened. The start of a new year offers a chance for you to get that information off your chest. Make the call.”

Anyone with information is urged to call police on 101 quoting the reference CAD224/08JUN.

Information can also be provided, anonymously, by calling Crimestoppers on 0800 555 111 or by visiting www.crimestoppers-uk.org.

Crimestoppers is an independent charity. They cannot trace your name or IP address and information is provided to them in full confidence.

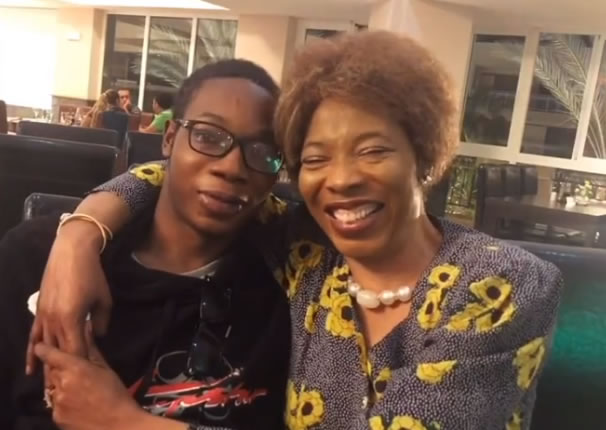

Alex Kareem with his mother

Detective Chief Inspector Wayne Jolley, Specialist Crime, said, “Today marks a month since Alexander was tragically shot, in what we now believe to be a case of mistaken identity. The month has seen officers working round the clock to locate those who have committed this horrendous crime.

"Officers have been analysing hours of CCTV from across London, and we hope these clips will help those who may have been in the area or seen this vehicle before to come forward with what they know.

“Alexander’s family continue to be in our thoughts and we are determined to help them get justice.”